What Is a Revocable Living Trust

How We Build One That Works for Your Family

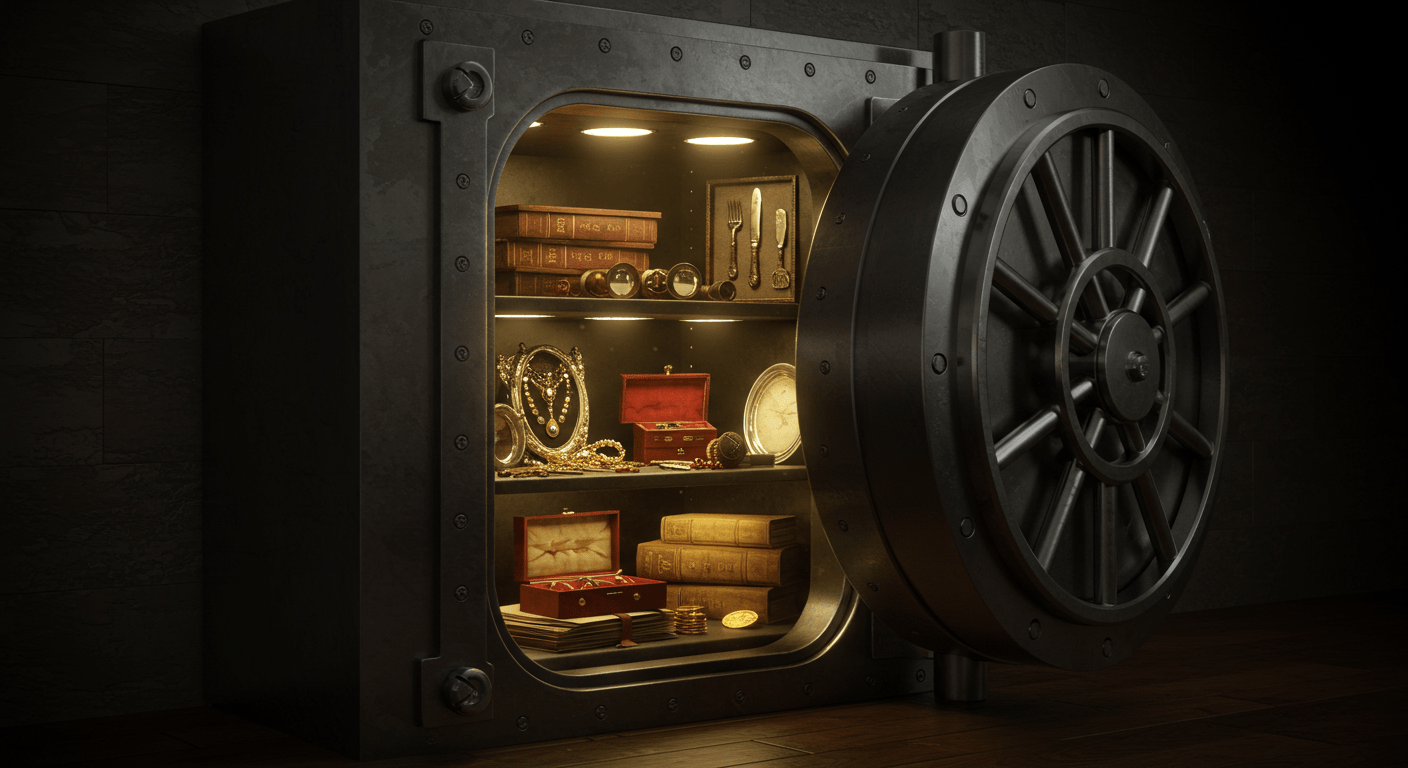

Picture everything you have built, from your home to your business to your savings, organized in one clear container that moves seamlessly to the next generation. That is the power of a revocable living trust when it is done right.

Many families come to us because they want peace of mind. They love their children and grandchildren, they worked hard to build something meaningful, and they want to protect it. The challenge is knowing what to include, how to structure distributions, and how to translate their wishes into legally sound documents that will actually work when it matters. At Costaras Law, we guide you through a thoughtful, step-by-step process to create a revocable living trust that fits your family and your assets.

Navigating Trustees & Beneficiaries

Clear steps to administer a Living Trust the right way

Comprehensive Trust & Estate Services

Protecting families and guiding trustees across Cleveland and Northeast Ohio

Trust Administration

Cleveland-based counsel for smooth, compliant administration after incapacity or death-minimizing delays and disputes.

- Revocable & Irrevocable Trust guidance

- Successor trustee onboarding & notices

- Private trust accounting services (Cleveland)

- Fiduciary duty checklist & timelines

- Beneficiary communication & releases

Funding a Living Trust

Without funding, a trust won't work. We verify titles and beneficiary designations so your plan actually performs.

- Trust funding audit (Ohio)

- Real estate deeds & affidavits

- Business interests & operating agreements

- Bank/brokerage/retirement alignments

- Revocable trust funding checklist

Protection for Beneficiaries

Strategic Planning Designed For Control, Protection, And Flexibility

Clear steps to administer a Living Trust the right way

We combine a caring, detailed intake with leading edge legal technology and plain-English explanations so you feel confident at every step.

- Discovery interview. We learn your family dynamics, priorities, and concerns. This includes children, grandchildren, marriages, and any unique circumstances.

- Asset mapping. We identify each major asset going into the trust, including real estate, business interests, investment and bank accounts.

- Distribution blueprint. We clarify how assets should flow. Examples include three children, a third each, or a set dollar amount to each grandchild followed by equal shares to children. Your wishes drive the plan.

- Leading edge drafting. We have invested in top legal technology that provides a strong starting point for trusts, wills, and estate planning documents across all states. We then tailor everything to you.

- Full customization. Every provision is calibrated to your goals, from trustee choices to successor trustees to specific gifts and timelines.

- Clarity first review. Trusts can run 50 to 200 pages. To make your review simple, we provide a concise executive summary that highlights the trustee, beneficiaries, assets, and distribution flow so key details are easy to confirm.

- Unlimited revisions, flat fee. We work on a flat fee basis, which covers the conversations and revisions needed until you are fully satisfied.

Protect Your Family with Guardianship & More

Customized planning for families with unique needs

Life doesn't always follow a script. Our attorneys create clear, Ohio-compliant plans so your children, step-children, and vulnerable adults are protected without court confusion or delay. (SEO: Ohio guardianship attorney, Cleveland blended family planning.)

No obligation • Confidential • Local Ohio attorneys